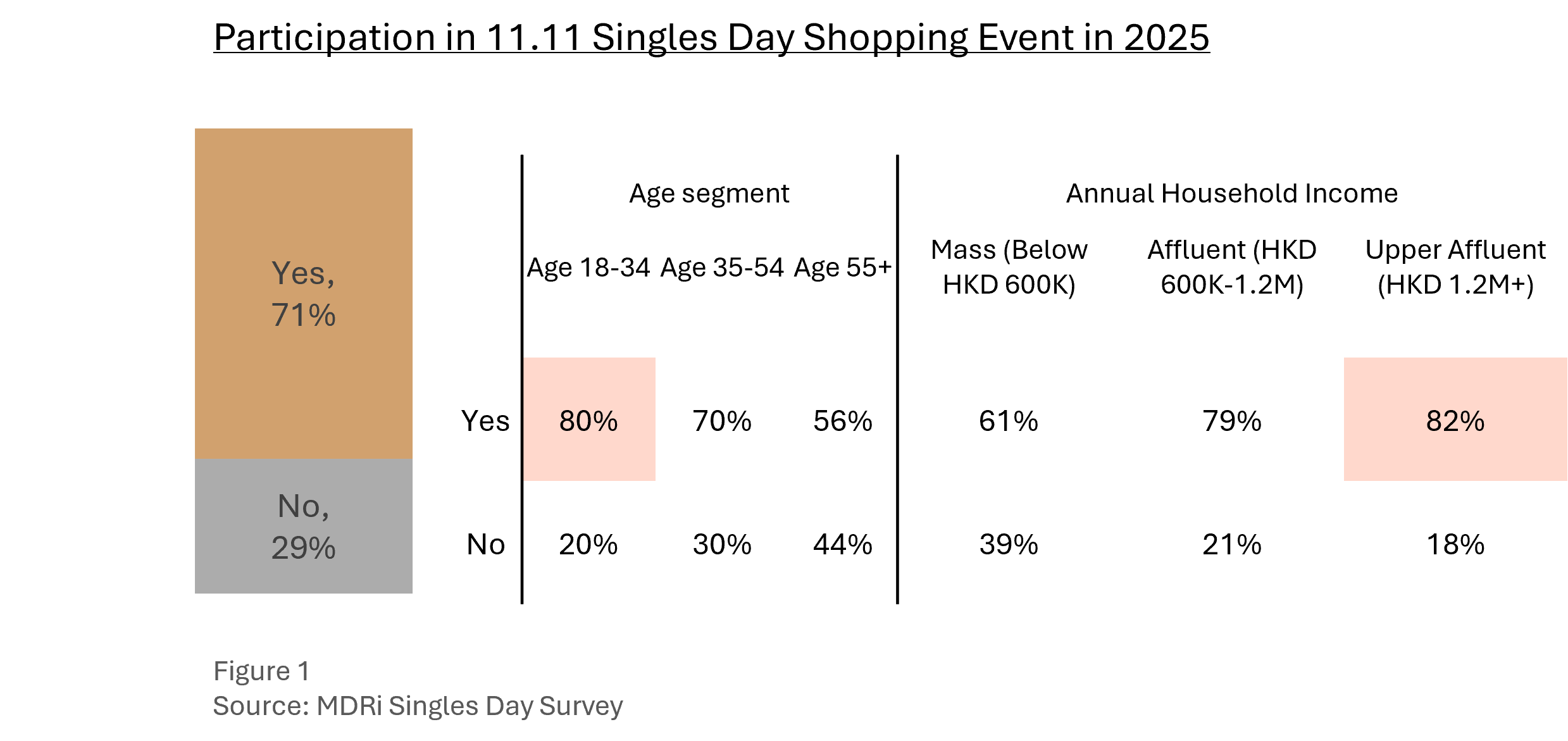

MDRi’s latest Singles Day survey shows the shopping festival remains popular with local consumers, with 71% of respondents reporting participation. This result includes strong showings among younger adults aged 18–34, at 80%, and affluent households earning over HKD 1.2 million, at 82%. (See figure 1) The research surveyed a representative sample of N = 500 Hong Kong residents on 12th and 13th November 2025.

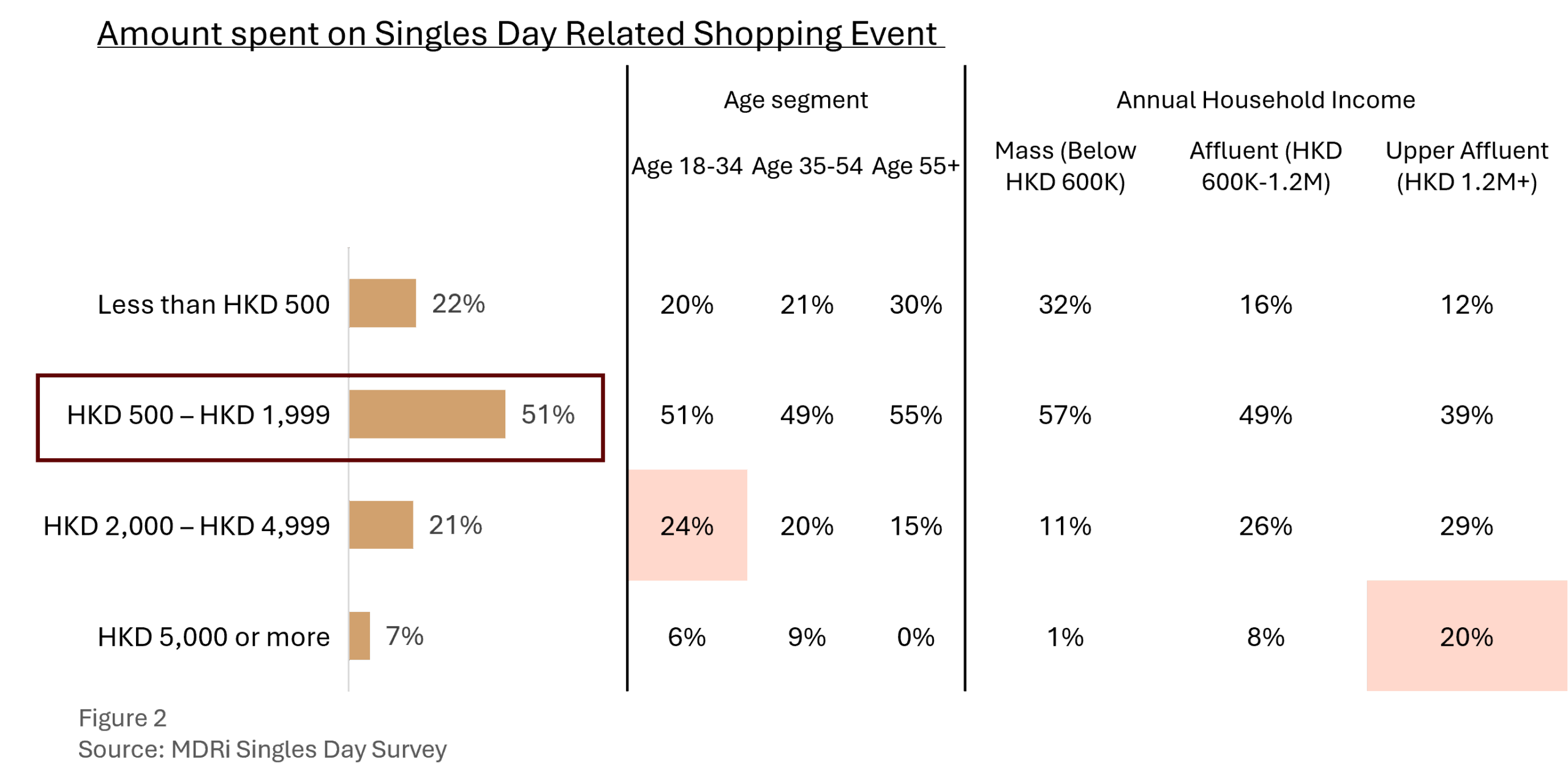

More than half of all respondents (51%) spent between HKD 500 and HKD 1,999. One-fifth of upper affluent shoppers spent over HKD 5,000, compared with 7% of the general population. Young adults ages 18–34 were more likely to spend between HKD 2,000 and HKD 4,999, at 24%, compared to 21% for all respondents. (See figure 2)

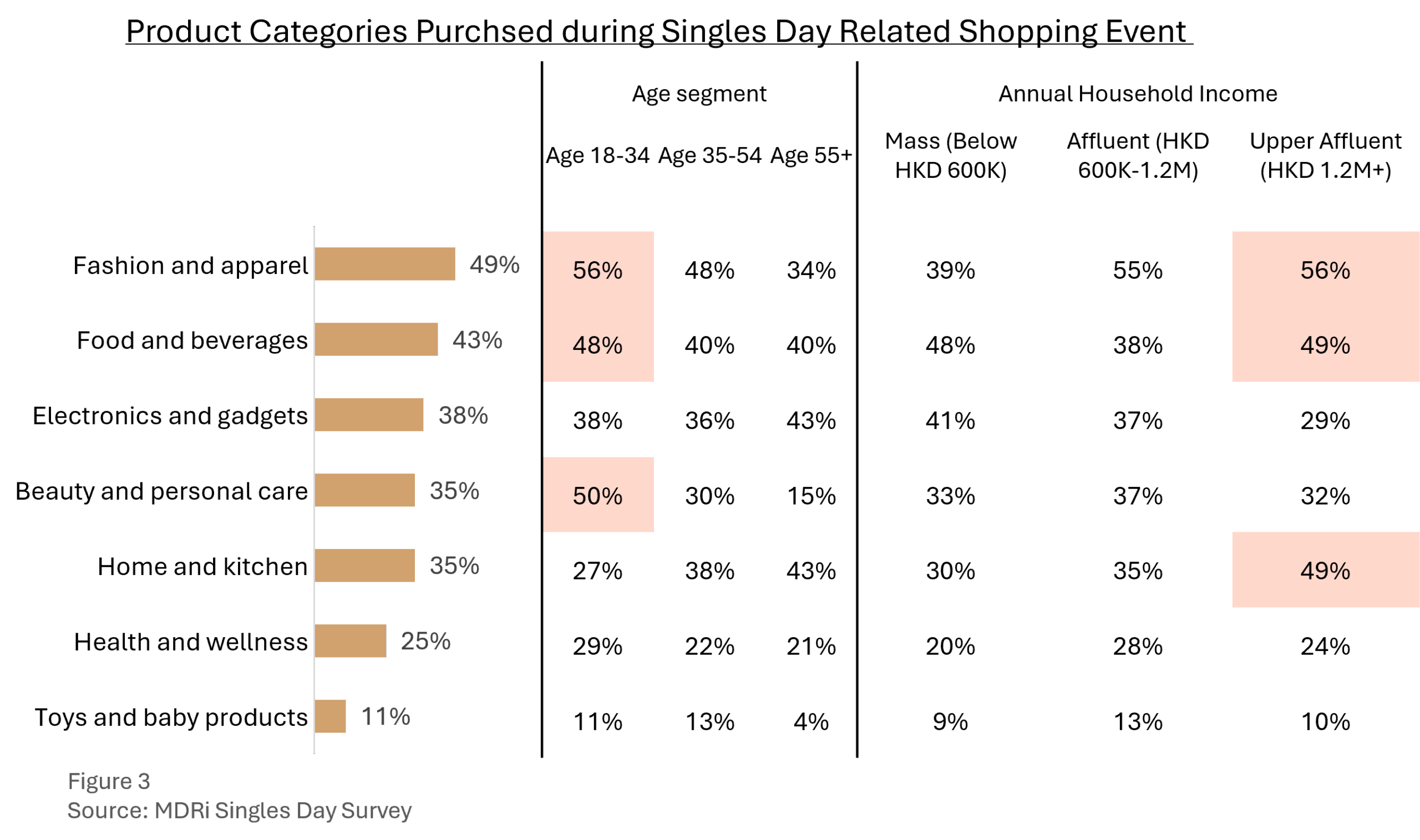

Singles Day has grown from a single day flash sale to a month-long campaign during its sixteen years in Hong Kong. Despite this change, enthusiasm remains high. Shoppers showed clear preferences: fashion and apparel was the top category at 49%, food and beverages at 43%, with electronics, beauty, and home each above 30%. Toys and baby products saw lower spending at 11%. (See figure 3)

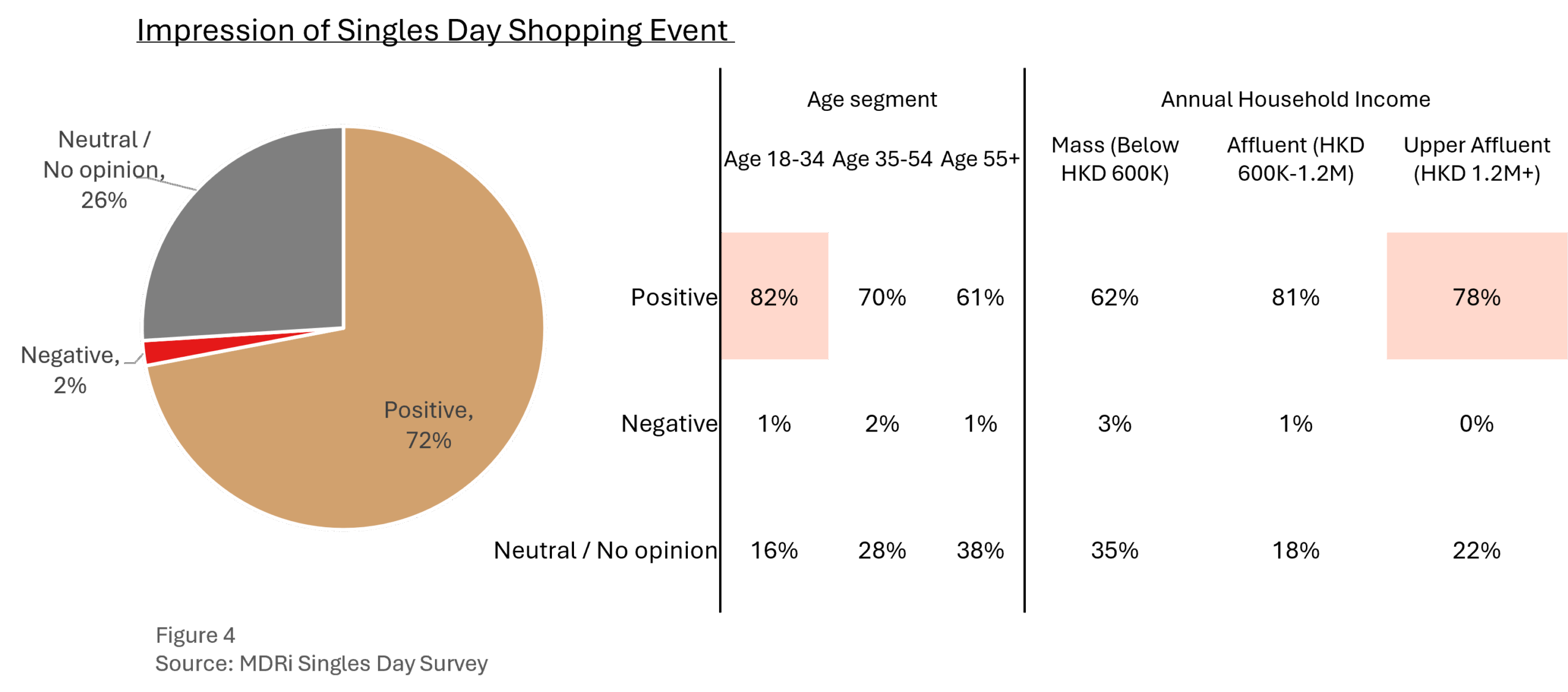

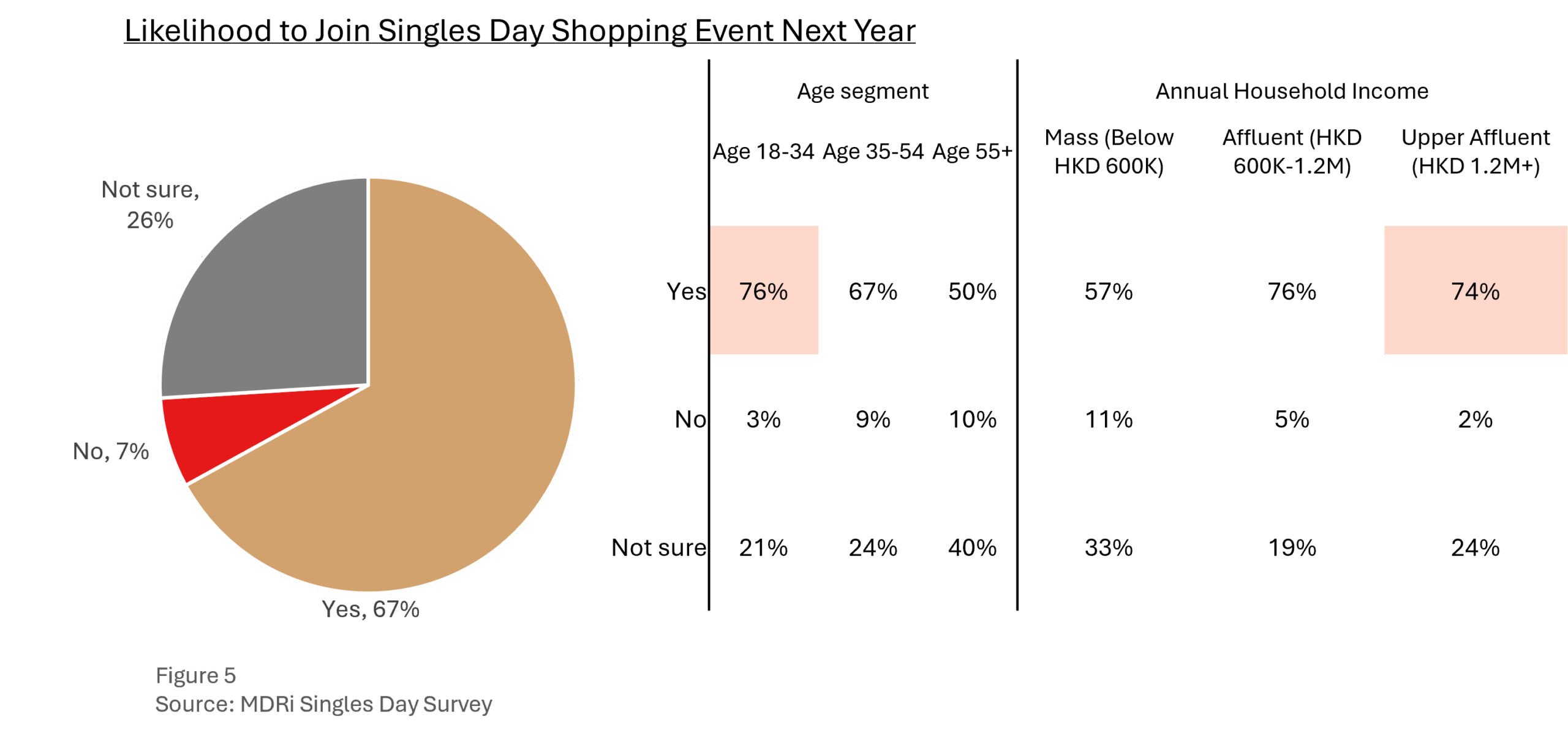

Younger consumers preferred shopping for fashion, beauty and food and beverage. Upper affluent customers showed higher spending in fashion, food and beverage, and home categories. Satisfaction was greater among the younger group (82%) and upper affluent segment (78%), compared to 72% overall. (See figure 4) 67% of all respondents expect to participate again next year, with higher rates among younger (76%) and upper affluent (74%) shoppers. (See figure 5)

Singles Day remains an important event in Hong Kong’s retail calendar, driven by strong participation and spending from young and affluent consumers.

Simon Tye, CEO of MDRi, commented:

“Participation and spending levels show that Hong Kong consumers have made Singles Day a key part of the year. Fashion and food are clear priorities. Younger and affluent shoppers continue to embrace the event. Retailers should keep improving the experience to encourage future participation.”

Retailers and brands have continued opportunity to grow, especially when both retailers and shoppers are ready for the Christmas shopping. Singles Day 2025 confirms ongoing engagement and the potential for further growth in Hong Kong’s retail landscape.